Below is the text of a speech I gave at South County Toastmasters in St. Louis, Missouri on Wednesday, February 11, 2015.

|

| Image Source: kspr.com/news |

I am here tonight to speak to my fellow Conservatives. Who

here tonight is a conservative? My speech tonight is for you, but the rest of

you can listen too. You probably were not aware of it, but I grew up as a

Conservative Republican. In my sophomore year of college, I was even President

of the College Republicans at William Jewell College. Here is a picture of me

from 25 years ago when I got to meet Missouri Governor John Ashcroft as a

leader of the College Republicans.

Check out my beautiful haircut from back then!

Speaking of great Conservatives, does anyone here know who

was the first world leader to address the United Nations General Assembly on

climate change? It was British Prime Minister Margaret Thatcher on November 8,1989.

was the first world leader to address the United Nations General Assembly on

climate change? It was British Prime Minister Margaret Thatcher on November 8,1989.

Anyone remember her nickname? It was “The Iron Lady” because of her solid Conservative principles. Even more, because

of her strong conservative principles, she was known for having a close

relationship with which US President? Ronald Reagan.

of her strong conservative principles, she was known for having a close

relationship with which US President? Ronald Reagan.

This is what Prime Minister Thatcher told the United Nations 26 years ago:

|

| Image Source: link2portal.com |

“What we are now doing to the world by degrading the

land surfaces, polluting the waters and by adding greenhouse gases to the air

at an unprecedented rate, all this is new in the experience of the earth.

land surfaces, polluting the waters and by adding greenhouse gases to the air

at an unprecedented rate, all this is new in the experience of the earth.

It is mankind and his activities which is changing the

environment of our planet in damaging and dangerous ways…

environment of our planet in damaging and dangerous ways…

We know more clearly than before (on planet earth) that we

carry common burdens, face common problems, and we must respond with common

action.”

carry common burdens, face common problems, and we must respond with common

action.”

My fellow conservatives, we were making the case that we

must take action to reduce the threat of climate change before liberals.

must take action to reduce the threat of climate change before liberals.

What is the best conservative solution to taking action on

climate change?

climate change?

|

| Image Source: scholar.harvard.edu |

Who is this conservative? This is Greg Mankiw, President

George W. Bush’s Chief Economist. He was

also an economic adviser to Mitt Romney before and during Romney’s 2012

presidential bid.

George W. Bush’s Chief Economist. He was

also an economic adviser to Mitt Romney before and during Romney’s 2012

presidential bid.

On January 3, 2006 Greg Mankiw wrote this editorial for the Wall

Street Journal, Repeat After Me. In this editorial, Mankiw wrote:

Street Journal, Repeat After Me. In this editorial, Mankiw wrote:

“I will advocate a carbon tax as the best way to control

global warming.”

global warming.”

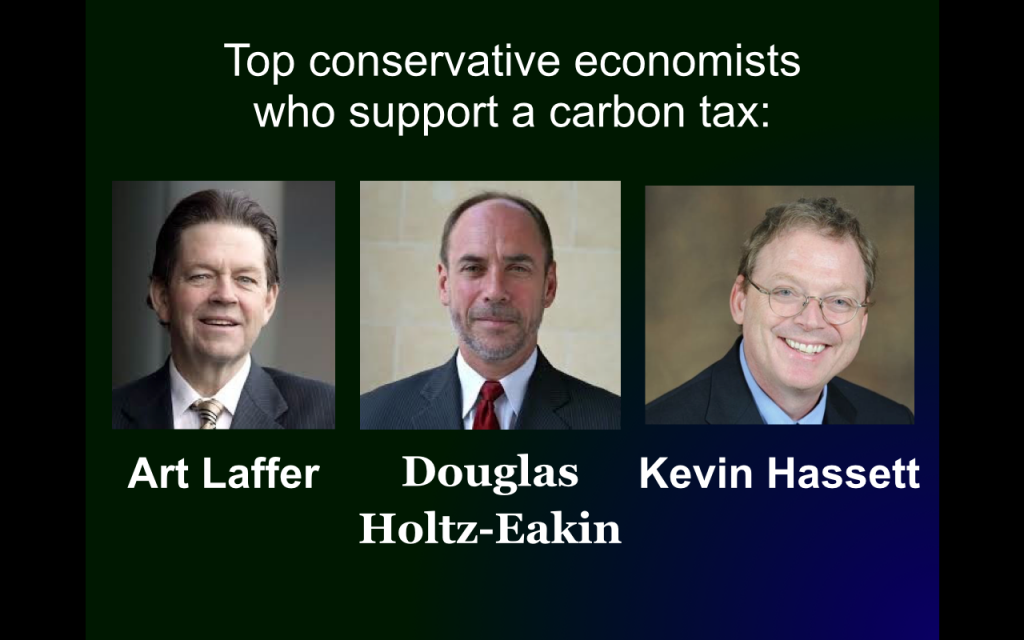

It’s not just conservative economist Greg Mankiw supporting

a carbon tax. All of the most prominent conservative economists also support a

carbon tax include:

a carbon tax. All of the most prominent conservative economists also support a

carbon tax include:

1.

Art Laffer, a top economic advisor to President Ronald Reagan.

Art Laffer, a top economic advisor to President Ronald Reagan.

2.

Douglas Holtz-Eakin, chief economic policy

adviser to U.S. Senator John McCain’s 2008 presidential campaign.

Douglas Holtz-Eakin, chief economic policy

adviser to U.S. Senator John McCain’s 2008 presidential campaign.

3.

Kevin Hassett, Director of Economic Policy

Studies at the conservative think tank, the American Enterprise Institute.

Kevin Hassett, Director of Economic Policy

Studies at the conservative think tank, the American Enterprise Institute.

It’s

not just these leading conservative economists supporting a carbon tax. Who is

this?

not just these leading conservative economists supporting a carbon tax. Who is

this?

|

| Image Source: insider.foxnews.com |

GeorgeWill, Conservative Political Commentator for FOX & ABC News also supports a carbon tax. Why do so many conservatives support this?

Because

they all think we should tax what we burn not what we earn. In economics, the

way to get less pollution is to make polluting expensive. One great example of

this is that conservative economists point out are cigarette taxes. Along with a change in attitudes about smoking and overwhelming scientific evidence, conservative economists point to the rise in cigarette taxes to dramatically reducing the numbers of Americans who smoke.

they all think we should tax what we burn not what we earn. In economics, the

way to get less pollution is to make polluting expensive. One great example of

this is that conservative economists point out are cigarette taxes. Along with a change in attitudes about smoking and overwhelming scientific evidence, conservative economists point to the rise in cigarette taxes to dramatically reducing the numbers of Americans who smoke.

A

carbon tax works like this: the less you pollute, the less you pay in taxes. Who here hates payroll, income taxes, and corporate taxes? For conservatives, a carbon tax is ideal because you reduce unhealthy and deadly pollution. According to the American Lung Association, particle pollution from coal power plants is estimated to kill approximately 13,000 Americans each year. At the same time, carbon taxes if they are revenue neutral, can increase personal income, which grows the economy and clean the air.

carbon tax works like this: the less you pollute, the less you pay in taxes. Who here hates payroll, income taxes, and corporate taxes? For conservatives, a carbon tax is ideal because you reduce unhealthy and deadly pollution. According to the American Lung Association, particle pollution from coal power plants is estimated to kill approximately 13,000 Americans each year. At the same time, carbon taxes if they are revenue neutral, can increase personal income, which grows the economy and clean the air.

I

first learned about a carbon tax three years ago by this volunteer non-partisan grassroots group, Citizens’ Climate Lobby or CCL. I am a the co-leader of the St. Louis group. This is what CCL proposes:

first learned about a carbon tax three years ago by this volunteer non-partisan grassroots group, Citizens’ Climate Lobby or CCL. I am a the co-leader of the St. Louis group. This is what CCL proposes:

|

| Image Source: citizensclimatelobby.org |

– This tax is placed on carbon-based fuels at the source

(well, mine, or border).

(well, mine, or border).

– It starts at $15 per ton of fossil CO2 emitted.

– It increases steadily each year by $10 so that clean

energy is cheaper than fossil fuels within a decade.

energy is cheaper than fossil fuels within a decade.

– All of the money collected is returned to American households

on an equal basis.

on an equal basis.

– Under this plan, 66 percent of all households would break

even or receive more in their dividend check than they would pay for the

increased cost of energy, thereby protecting the poor and middle class.

even or receive more in their dividend check than they would pay for the

increased cost of energy, thereby protecting the poor and middle class.

– A predictably increasing carbon price will send a clear

market signal, which will unleash entrepreneurs and investors in the new

clean-energy economy.

market signal, which will unleash entrepreneurs and investors in the new

clean-energy economy.

|

| Image Source: fleetcarma.com |

Are carbon taxes successful?

British Columbia enacted one in 2008. According to stand up economist Yoram Bauman, here are the results:

–

It has had no small business tax since 2012.

It has had no small business tax since 2012.

–

It has the lowest corporate tax rate of the

world’s most industrialized nations.

It has the lowest corporate tax rate of the

world’s most industrialized nations.

–

A family of four receives $300 annually to

offset the tax.

A family of four receives $300 annually to

offset the tax.

–

Lowest provincial income tax up to $119,000.

Lowest provincial income tax up to $119,000.

Best of all, British Colombia’s fuel consumption per person has declined by 17.4 per cent from the 2008 to 2012.

Why is a revenue neutral carbon tax the best solution for

Conservatives?

Conservatives?

1.

It does not add to the federal deficit or

federal debt. That is because it is revenue neutral.

It does not add to the federal deficit or

federal debt. That is because it is revenue neutral.

2.

It does not grow the size of the federal

government. That is because no big government agency or bureaucracy is added.

It does not grow the size of the federal

government. That is because no big government agency or bureaucracy is added.

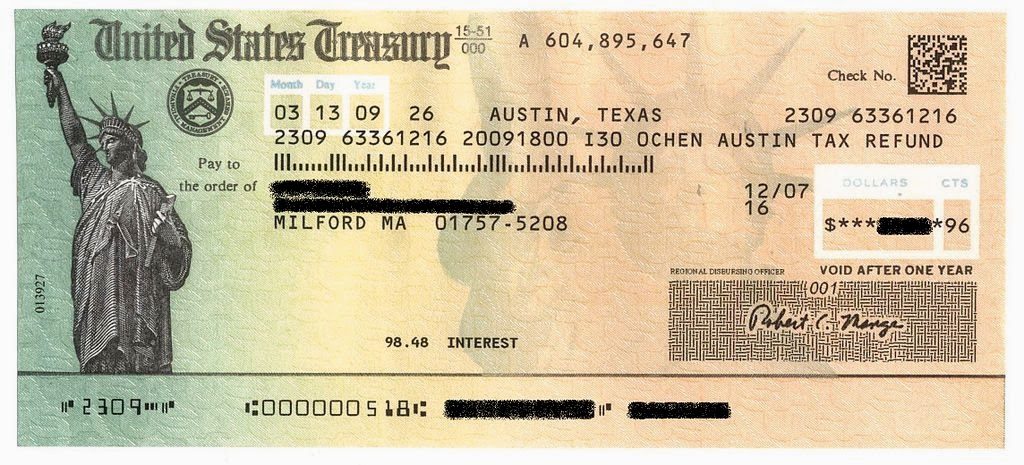

3.

It is easy to administer. Who here receives a

social security check or has received a tax refund check? The same mechanism that cuts you a check for social

security or tax refund would also cut you a monthly check for the carbon

dividend.

It is easy to administer. Who here receives a

social security check or has received a tax refund check? The same mechanism that cuts you a check for social

security or tax refund would also cut you a monthly check for the carbon

dividend.

|

| Image Source: zh.wikipedia.org |

Now I have been giving this presentation in Missouri for the

past year. Here I am giving this same talk in Union, MO last April for a group of almost 50 people. This is the

strongest criticism I have received fellow conservatives attending my talks.

They tell me that we cannot trust politicians especially with taxes. They will

never keep let this tax be revenue neutral and return all the money to American

households. They will just divert this money to their special interest

projects.

past year. Here I am giving this same talk in Union, MO last April for a group of almost 50 people. This is the

strongest criticism I have received fellow conservatives attending my talks.

They tell me that we cannot trust politicians especially with taxes. They will

never keep let this tax be revenue neutral and return all the money to American

households. They will just divert this money to their special interest

projects.

That is a valid argument. However, my friend that I

got to meet in person a year ago, conservative Republican former Congressman Bob Inglis of South Carolina has a great response:

got to meet in person a year ago, conservative Republican former Congressman Bob Inglis of South Carolina has a great response:

“If that is true, then we need to write to the British Monarchy

and ask them to come back. We will need to tell them that our experience in

self-governance has failed.

and ask them to come back. We will need to tell them that our experience in

self-governance has failed.

We are not capable of governing ourselves and,

really, we want you back. We need some wise one over us to make decisions for

us because we cannot do it.

really, we want you back. We need some wise one over us to make decisions for

us because we cannot do it.

I don’t know about you, but I am not ready to make

that concession. I believe that a free people can govern themselves

that concession. I believe that a free people can govern themselves

The answer is simply, rise up Americans. Realize you are

free citizens. Impose accountability on your elected officials. If they do

something you don’t like, you get rid of them. That is what free people do.”

free citizens. Impose accountability on your elected officials. If they do

something you don’t like, you get rid of them. That is what free people do.”

I know I will never be as smart as Bob Inglis, George Will, Greg Mankiw, or other conservatives who support a revenue neutral

carbon tax.

carbon tax.

However, I now know three sure things about life:

1. Death & Taxes

2. Don’t get caught with a bad haircut when you do

meet famous conservatives.

3. A carbon tax is good for conservatives and you!